New COVID Bill – Feb 9, 2021

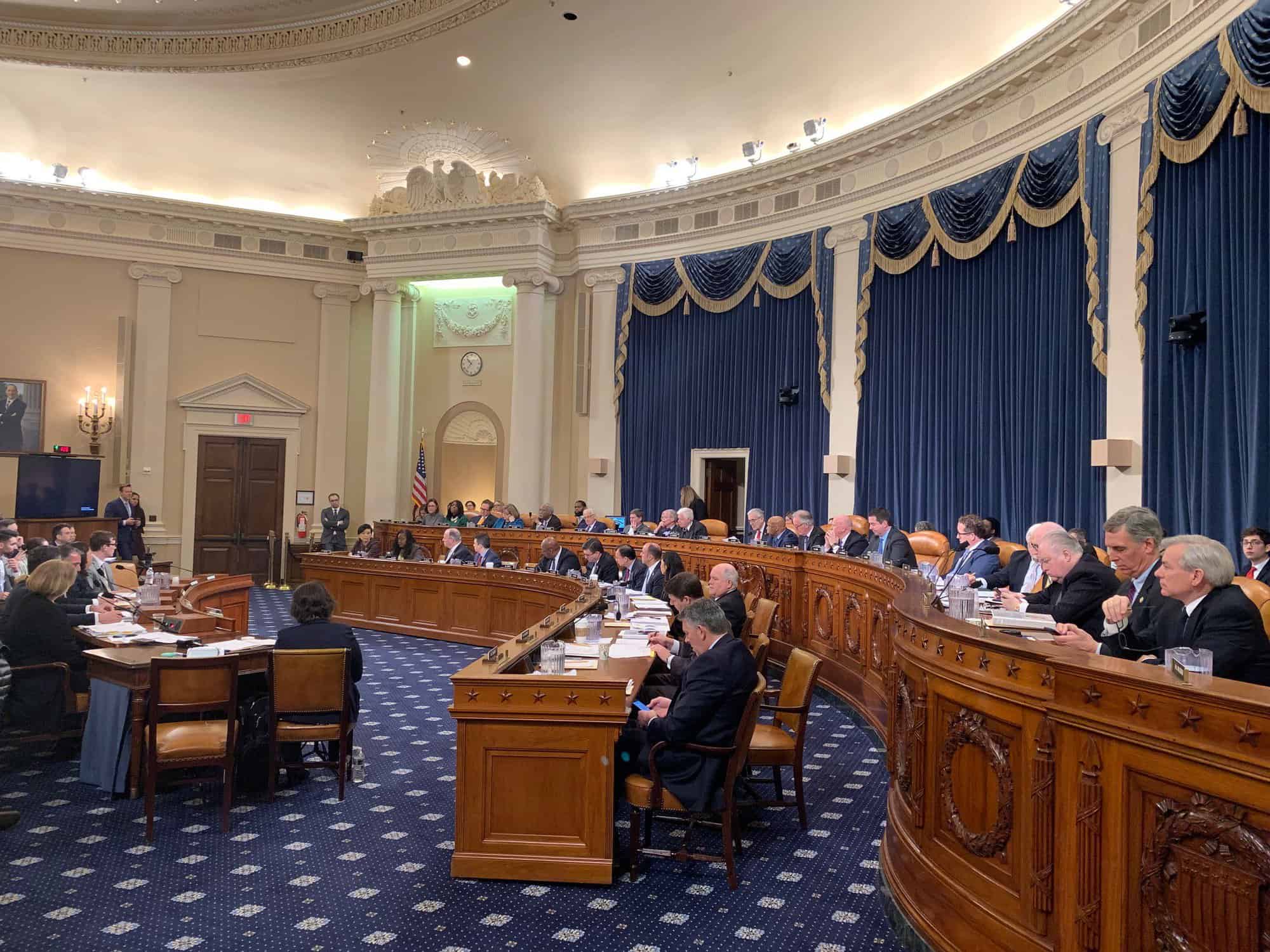

Today the House Ways and Means Committee released nine legislative proposals to help deliver additional COVID relief.

A few things identified in the bill are as follows:

- Additional direct payment of $1,400 per person

- Earned Income Tax Credit for workers without children by nearly tripling the maximum credit and extending eligibility

- Child Tax Credit to $3,000 per child ($3,600 for children under 6), and makes it fully refundable and advanceable.

- ERTC will extend to Q4 2021 (instead of Q2 only under Section 207) allowing up to 7k as a credit per employee, up to $28k credit per year per employee.

- FFCRA credit to be extended to 9/30/2021

We are doing a lot of work in and around the ERTC tax credits.

These tax credits can easily prove to be THE MOST VALUABLE incentive of 2021.

But also THE MOST COMPLEX.

Most accountants aren’t even aware of these credits.

Even when they are, they haven’t built the team to maximize your credit while avoiding the 100+ IRS booby traps that disqualify you for these credits and expose you to unnecessary audit risk (otherwise known as ERTC FAQs).

If you’re a client, we’re already working on those for you.

Want to see what that process looks like? I’ll show you all my tools.

Talk soon,

Brad Mewes

Founder, Covid19Loans.org