Don’t throw away money!

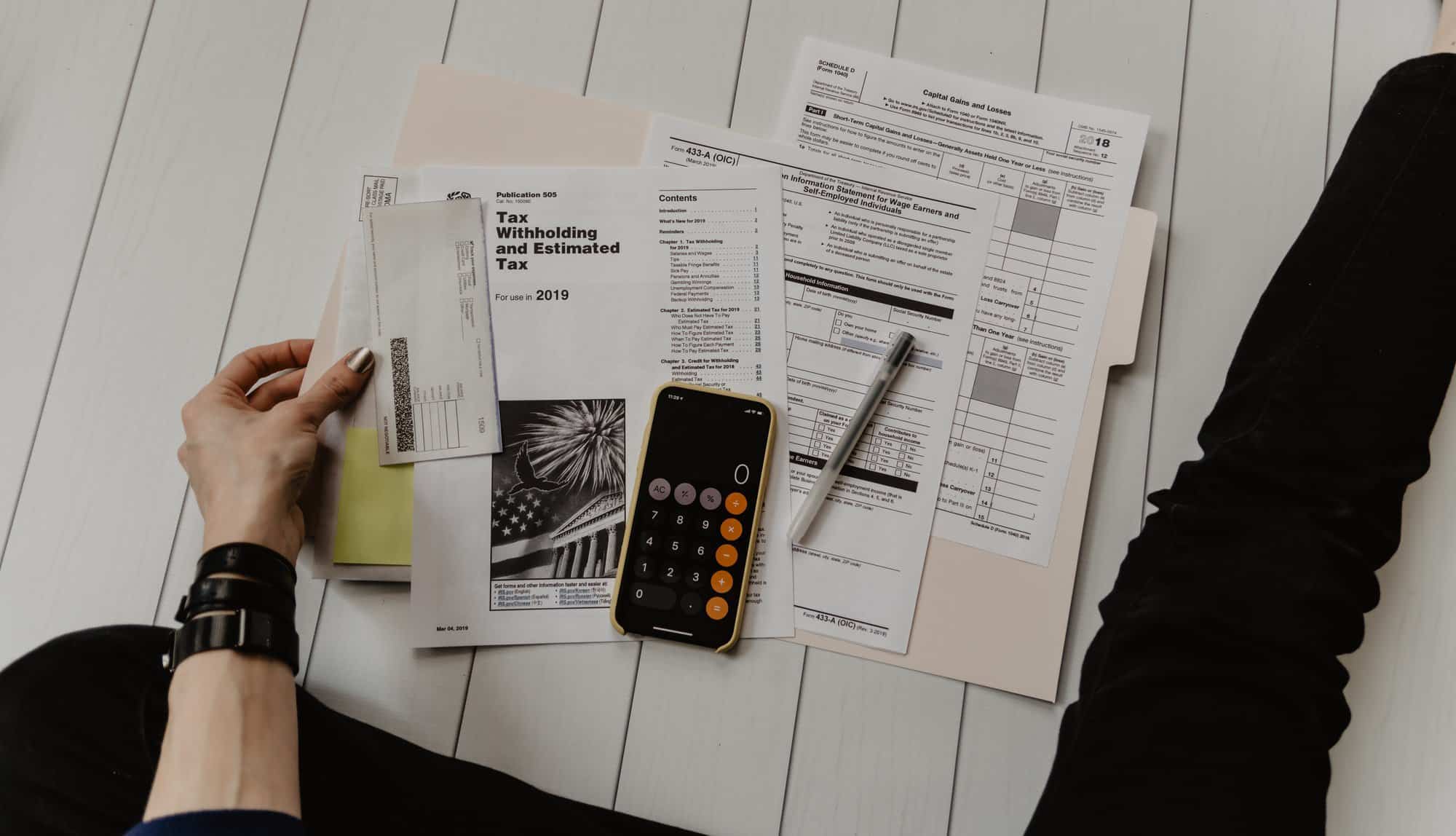

How do you actually know when you get your employee retention tax credit? This question came up with a client of mine recently. He recently received a check in the mail from the treasury and with zero context or warning. He had no idea what it was.

Exciting and yet anticlimactic!

Getting a check in the mail is inherently a very exciting prospect. Yet somehow this process was made as anticlimactic as possible. For those that got the PPP, you may remember your bank calling about the deposit to verify the funds were available. If you have an advisor like myself, you probably got a call from us to congratulate you. It was hard to miss and came with a certain amount of pomp and circumstance. The employee retention tax credit is the polar opposite. It’s just a check in the mail.

Don’t accidentally throw it away!

The check comes with no context, no letter to explain, no confirmation of what is enclosed; just a check from the treasury. The only meaningful information on it is the amount it is for. It is so out of place that I have heard of people almost mistakenly throwing it away! It’s a check, it’s your income and you can do with it as you see fit for yourself and your business.

Depending on the form you fill out, the overall process can take anywhere from 6-7 weeks, all the way up to 6-7 months! Ask your advisor for some additional context so you can keep your eyes peeled and make sure you have at least some idea when to expect it.

Don’t miss out on getting your check

If you’d like some help with the employee retention tax credits, reach out and let us help. We can walk you through the process, the qualifiers and dive deep into your specific circumstances to establish whether or not you qualify. When it is all said and done we will get you the most aid possible.

For a layman’s guide to the employee retention tax credit check out our roadmap below:

A layman’s guide to the employee retention tax credit!

Have questions that aren’t answered in the article or video? Book time with Brad today by clicking here!