$500,000 check from the IRS?!

Can you imagine getting a check for $500,000 from the IRS? Three clients of mine recently didn't have to use their imaginations, they just had to check their mail!

California Autobody webinar features Brad Mewes!

In a recent webinar with the California Autobody Association Brad was a featured guest. Their webinar discussed missed opportunities for autobody shops and how they were impacted by recent shutdowns and supply shortages. Read a summary of that dicussion here

Employee retention tax credit and the PPP/PPP2: Can you have both? (YES!)

Under the impression that you can't take advantage fo the employee retention tax credit if you got the PPP/PPP 2? You are far from being alone and there's a good chance you are wrong!

Can your essential business get the employee retention tax credit? (yes!)

Could you be eligible for the employee retention tax credit even as an essential business? Learn about meaningful exemptions that could put money back in your pocket!

Should you fear and audit when you apply for the employee retention tax credit?

Should you fear and audit when you apply for the employee retention tax credit? Find out how to avoid it here.

Can your business get the employee retention tax credit if you’ve already got the PPP & PPP2? (yes!)

A client came to me, his accountant told him that you can't get retention tax credits tax credit because he already got the PPP & PPP2 and the restaurant revitalization fund. THAT IS WRONG.

ERTC payroll tax credit review and qualification process explained

We always follow this same three-step process every single time to get the ERTC payroll credits your business deserves. It’s very important we follow the detailed process as this process actually extends to getting every dollar you are owed.

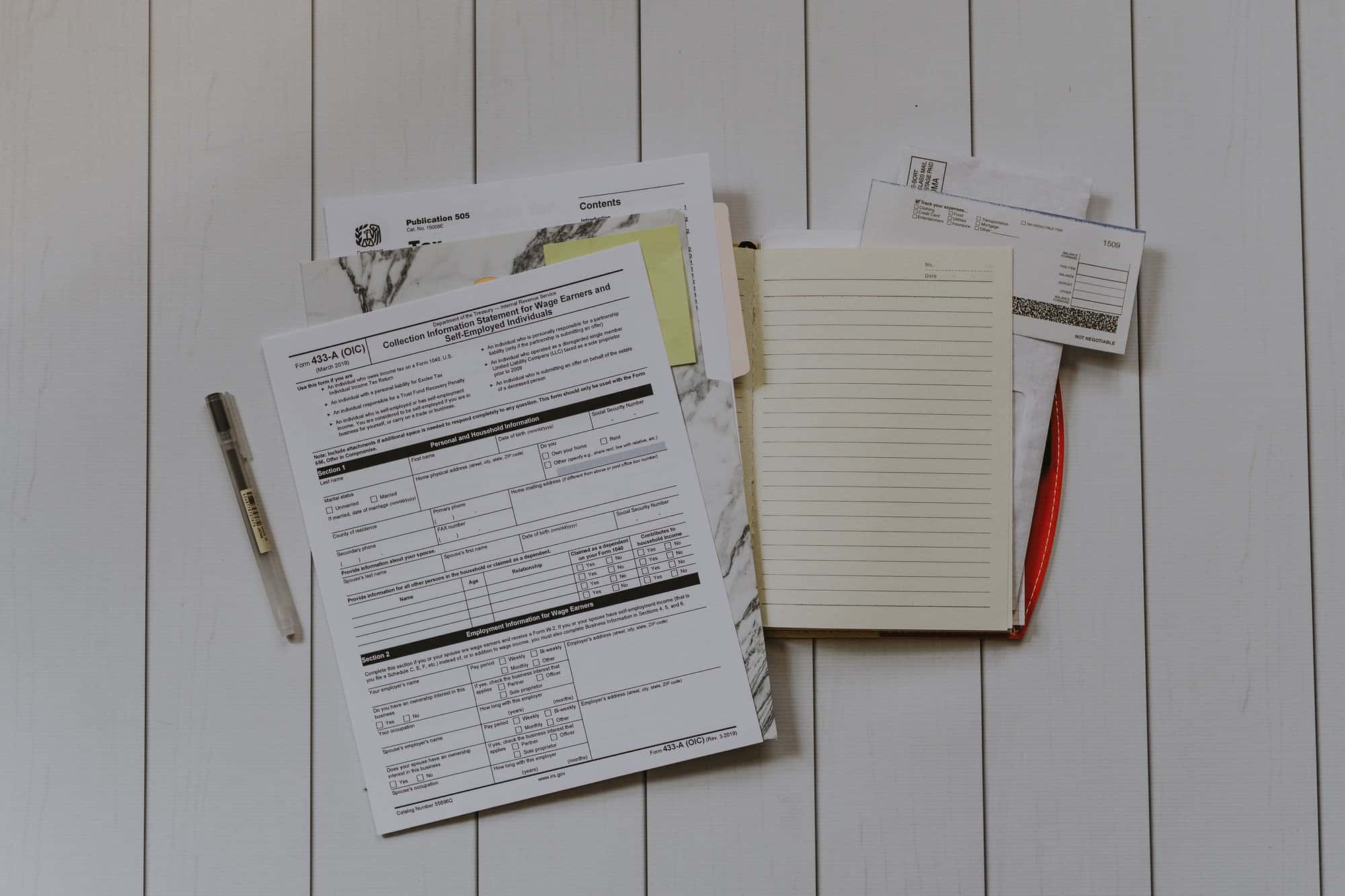

What are the forms and related timelines to claim the ERTC stimulus money owed to my company?

There's a lot of rules around what it takes to get and claim the government money STILL owed to your business. There are probably 200 plus pages of IRS Guidance on this ERTC credit, but it isn’t even all in